Current Child Care Tax Credit Starts to Phase Out After $15K in Income, Leaving Out Many Middle Class Pennsylvania Families / Child Care Costs for PA Families Up 70% Since 1985; Average Cost of Caring For Child Through Age 17 is Nearly $235,000- Up 20% Since 1960 / Casey Proposal Would Expand Eligibility, Include Bonus for Families with Children Under 5 Years Old

Washington, DC – Today, U.S. Senator Bob Casey (D-PA), a member of the Senate Finance Committee unveiled an expanded child care tax credit. The current child care tax credit begins to phase out after $15,000 in income, leaving out many middle class Pennsylvania families. At the same time, new data shows that the cost of raising a child is increasing dramatically. A recent Pew study of Census Bureau data found that average weekly child-care expenses, measured in inflation-adjusted 2013 dollars, rose from $87 in 1985 to $148 in 2013, an increase of more than 70 percent. Mark Lino, an economist at the Department of Agriculture, has found that raising a child born in 2013 will cost an average of $245,340 through age 17 an increase of more than 23 percent from 1960 when adjusted for inflation.

“Expanding the child care tax credit will ensure that more middle class families in Pennsylvania and throughout the nation can take advantage of its benefits,” Senator Casey said. “The current child care tax credit phases out after the first $15,000 of income which leaves far too many working families behind. Affordable, high quality child care is no longer a luxury- it’s a necessity and this legislation recognizes that.”

Casey’s proposal would:

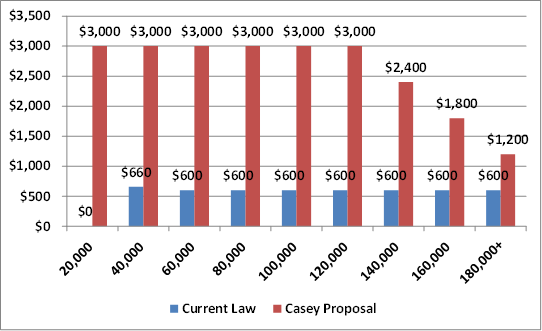

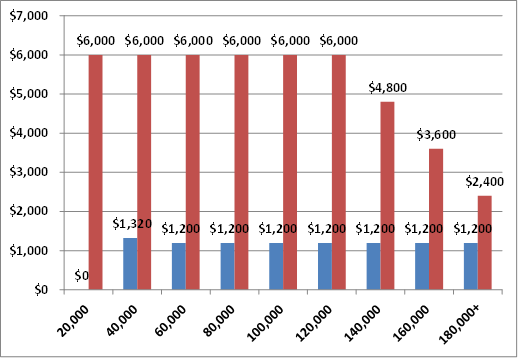

- Making the full credit available to most working families: Senator Casey’s bill would make the full credit available to families with income under $120,000. Currently the phase out of the credit begins at $15,000 of income.

- Providing a bonus for young children under five: The bill increases the credit from $1,500 to $3,000 per child for kids under five.

- Ensuring lower income families see a benefit: Senator Casey’s bill would make the credit fully refundable to make sure those with the greatest need see a benefit.

- Retaining the value over time: Senator Casey’s bill would index benefits to inflation to ensure they keep up with ever-growing costs.

Casey was joined on the call by Joan Benso, President and CEO of the Pennsylvania Partnerships for Children, to make the case for the new legislation.

“High-quality child care is beyond the financial reach of far too many families in our state and across the nation,” said Joan Benson. “Senator Casey’s proposal would help many more families afford the kind of child care that will help their children grow and develop to their full potential.”

The legislation is currently endorsed by: Child Care Aware of America, First Focus Campaign for Children, National Women’s Law Center, Pennsylvania Partnerships for Children, Zero to Three, First Five Years Fund, Ounce of Prevention Fund, National Association for the Education of Young Children, National Head Start Association, Restaurant Opportunities Centers United, Moms Rising, and American Federation of Teachers.

Current law vs Casey Proposal: Families with One Child Under Five

Current law vs Casey Proposal: Families with Two Children Under Five

###